Maine state tax deduction. Maine offers $1,000 Maine income tax deduction contributions to NextGen 529 (and other 529 plan). Tax filers claim deduction their federal adjusted gross income $100,000 less filing single married filing separately, $200,000 less filing head household married .

Maine state taxpayers earning than $100,000 filing single married filing separately $200,000 filing head household married filing jointly claim tax deduction up $1,000 student (designated beneficiary) the portion contributions made the student's Section 529 plan account.

Maine state taxpayers earning than $100,000 filing single married filing separately $200,000 filing head household married filing jointly claim tax deduction up $1,000 student (designated beneficiary) the portion contributions made the student's Section 529 plan account.

The Maine legislature reinstated increased state income tax deduction for who 529 contributions, entitling qualifying Maine residents a $1,000 deduction, beneficiary. . (not the Maine plan) eligible, the deduction only to Maine residents federal adjusted gross income up .

The Maine legislature reinstated increased state income tax deduction for who 529 contributions, entitling qualifying Maine residents a $1,000 deduction, beneficiary. . (not the Maine plan) eligible, the deduction only to Maine residents federal adjusted gross income up .

Maine 529 Plan Tax Information. Tax savings one the big benefits using 529 plan save college. . Maine once offers tax deduction contributions. Maine state taxpayers earning than $100,000 filing single married filing separately $200,000 filing head household married filing jointly .

Maine 529 Plan Tax Information. Tax savings one the big benefits using 529 plan save college. . Maine once offers tax deduction contributions. Maine state taxpayers earning than $100,000 filing single married filing separately $200,000 filing head household married filing jointly .

Maine offers $1,000 Maine income tax deduction contributions to NextGen 529 (and other 529 plan). Tax filers claim deduction their federal adjusted gross income $100,000 less filing single married filing separately, $200,000 less filing head household married filing jointly. states .

Maine offers $1,000 Maine income tax deduction contributions to NextGen 529 (and other 529 plan). Tax filers claim deduction their federal adjusted gross income $100,000 less filing single married filing separately, $200,000 less filing head household married filing jointly. states .

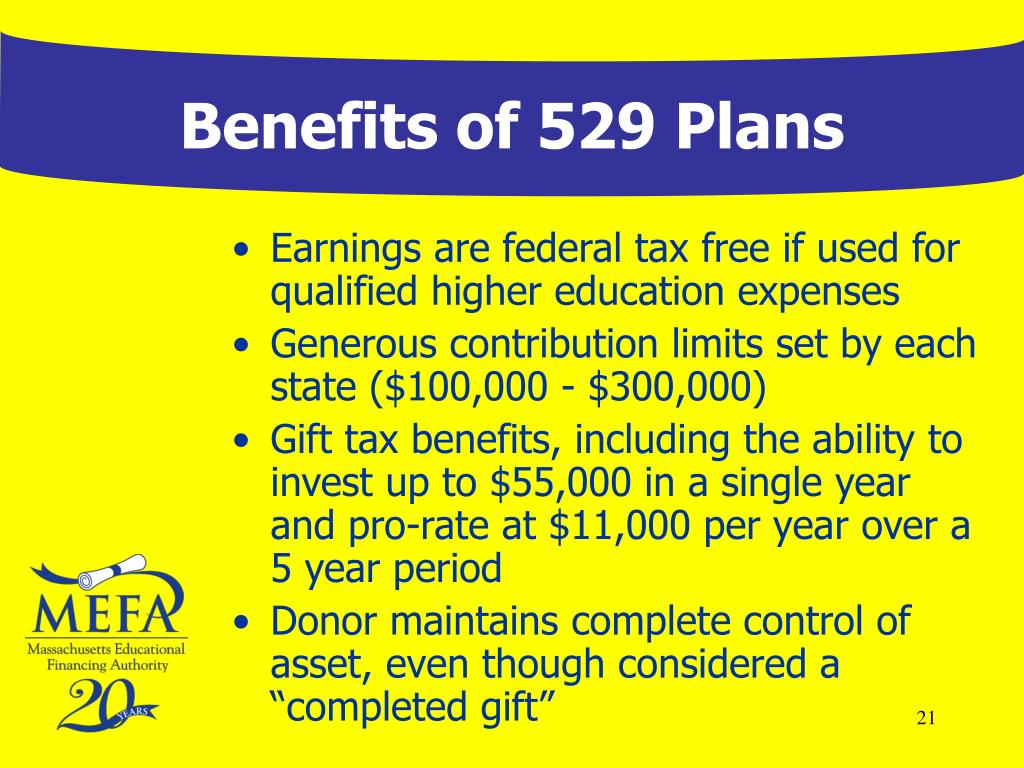

NextGen 529 Maine's section 529 plan many Maine families to save college. . through payroll deduction. Check your employer find if can process payroll direct deposits. . may be to advantage a federal gift tax election applies to 529 plan contributions. election .

NextGen 529 Maine's section 529 plan many Maine families to save college. . through payroll deduction. Check your employer find if can process payroll direct deposits. . may be to advantage a federal gift tax election applies to 529 plan contributions. election .

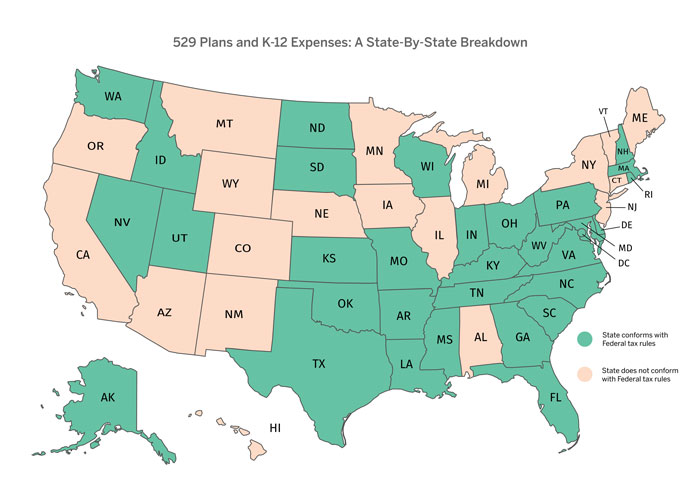

A 529 plan tax deduction help save for college. how a 529 plan tax deduction worth your state. {{parent.title}} . Maine, Minnesota, Missouri, Montana, Ohio, Pennsylvania, may able claim state tax deduction 529 plan contributions make an out-of-state plan. 5.

A 529 plan tax deduction help save for college. how a 529 plan tax deduction worth your state. {{parent.title}} . Maine, Minnesota, Missouri, Montana, Ohio, Pennsylvania, may able claim state tax deduction 529 plan contributions make an out-of-state plan. 5.

Maine residents contribute any state's Section 529 plan to receive state income tax deduction up $250 beneficiary tax return. Maine residents entitled multiple deductions to limit $250 child they contributed behalf multiple beneficiaries—the children dependents will using funds attend school pursue .

Maine residents contribute any state's Section 529 plan to receive state income tax deduction up $250 beneficiary tax return. Maine residents entitled multiple deductions to limit $250 child they contributed behalf multiple beneficiaries—the children dependents will using funds attend school pursue .

Beginning 2023, income subtraction modification contributions a qualified tuition program established the 529 plan reinstated. Prior 2023, Maine not offer deduction your state tax return contributions made. However, allow subtraction earnings a 529 account. are deduction limits?

Beginning 2023, income subtraction modification contributions a qualified tuition program established the 529 plan reinstated. Prior 2023, Maine not offer deduction your state tax return contributions made. However, allow subtraction earnings a 529 account. are deduction limits?

The State Maine reinstated (and increased) deduction the tax year 2023 contributions Qualified Tuition Programs, commonly as "529 College Savings Plans." Deductions up $1,000 student available single married filing separate taxpayers making to $100,000 for married filing joint head .

The State Maine reinstated (and increased) deduction the tax year 2023 contributions Qualified Tuition Programs, commonly as "529 College Savings Plans." Deductions up $1,000 student available single married filing separate taxpayers making to $100,000 for married filing joint head .

How Much Is Your State's 529 Plan Tax Deduction Really Worth?

How Much Is Your State's 529 Plan Tax Deduction Really Worth?

529 Tax Deduction

529 Tax Deduction

Tax Benefits of a 529 Plan

Tax Benefits of a 529 Plan

How Tax-Free Distribution on a 529 Plan Works

How Tax-Free Distribution on a 529 Plan Works

Infographic: 529 State Tax Deduction Value Comparison Map, 53% OFF

Infographic: 529 State Tax Deduction Value Comparison Map, 53% OFF

Maine 529 Plan And College Savings Options | NextGen 529

Maine 529 Plan And College Savings Options | NextGen 529

New 529 Income Tax Deduction for Maine Residents - HM Payson

New 529 Income Tax Deduction for Maine Residents - HM Payson

USA | 529 Plan Tax Savings (2019) | How to plan, Tax deductions, 529 plan

USA | 529 Plan Tax Savings (2019) | How to plan, Tax deductions, 529 plan

PPT - 529 College Savings Plans: A National Overview PowerPoint

PPT - 529 College Savings Plans: A National Overview PowerPoint

Tax Advantages of 529 Plans

Tax Advantages of 529 Plans